Balancing founder incentives with the interests of investors and the community.

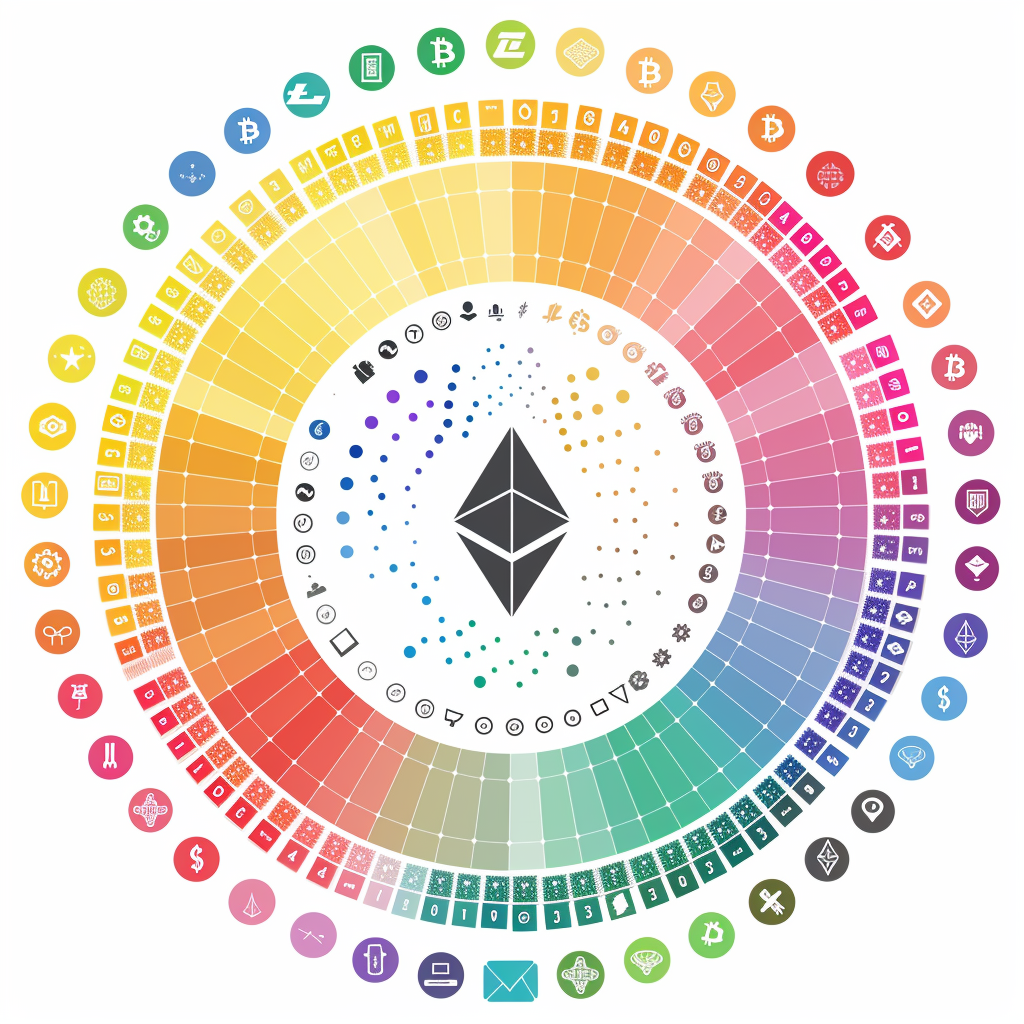

The percentage of tokens allocated to founders and early team members in a crypto project can vary widely depending on several factors including the project’s goals, funding requirements, and the team’s contribution. However, there are some general trends and ranges that can be observed in the crypto space.

**Initial Allocation**: Typically, founders and early team members receive a significant portion of tokens during the initial token distribution. This can range anywhere from 15% to 30% or even higher, depending on the project.

**Vesting Period**: To align the interests of the team with the long-term success of the project and to prevent token dumping, these tokens often come with a vesting period. This means that the tokens are locked up for a certain period of time before they can be fully accessed by the team members.

**Tokenomics**: The distribution of tokens among founders, advisors, investors, and the community is an essential aspect of a project’s tokenomics. This distribution can significantly impact factors such as decentralization, governance, and network security.

Here are Examples:

1) Ethereum: Ethereum’s founders initially received approximately 17.7% of the total token supply. This allocation was criticized by some for being too high, but Ethereum has still managed to become one of the most successful blockchain platforms.

2) Binance Coin (BNB): Binance, one of the largest cryptocurrency exchanges, allocated 40% of the total token supply to the founding team and early investors. This allocation was seen as high but contributed to the rapid growth of the platform.

3) Polkadot (DOT): Polkadot’s founders and early contributors received around 30% of the initial token supply. However, like many projects, this allocation is subject to vesting over several years to ensure long-term commitment.

4) Solana (SOL): Solana allocated a relatively smaller percentage of tokens to its founders and early team members, with approximately 12% of the initial token supply reserved for this purpose.

5) Cardano (ADA): Founder Allocation: Cardano allocated around 19% of its total token supply to the project’s founders and early contributors.

Tokenomics: Cardano employs a proof-of-stake consensus mechanism and has a unique governance model designed to foster decentralization and scalability. Token holders can participate in the platform’s governance through a liquid democracy system.

6) Chainlink (LINK): Founder Allocation: Chainlink allocated approximately 35% of its total token supply to the founding team, early contributors, and advisors.

Tokenomics: LINK tokens are used to pay for services on the Chainlink decentralized oracle network. The project focuses on providing reliable data feeds to smart contracts, enabling them to interact with real-world data securely.

7) Aave (AAVE): Founder Allocation: Aave initially allocated around 24% of its total token supply to founders, early team members, and advisors.

Tokenomics: AAVE tokens are used for governance and fee payments on the Aave protocol, which is a decentralized lending and borrowing platform. The project aims to provide efficient and secure financial services on the Ethereum blockchain.

8) Filecoin (FIL):

– Founder Allocation: Filecoin allocated approximately 20% of its total token supply to the project’s founders, investors, and team members.

Tokenomics: FIL tokens are used to pay for storage and retrieval services on the Filecoin network, a decentralized storage platform. Filecoin aims to create a decentralized and efficient marketplace for storage solutions.

The above examples showcase the diverse tokenomics models and founder allocations in the crypto space. Each project tailors its token distribution and tokenomics to achieve specific goals related to decentralization, governance, and utility within its ecosystem.

**Ranges**: While there’s no hard and fast rule, a common range for founder and early team token allocations might be between 10% and 30% of the initial token supply. However, these figures can vary widely depending on the project’s specifics and its funding requirements.

It’s important for investors and community members to scrutinize token allocations and vesting schedules to ensure fairness and alignment of incentives within a project. Transparency in token distribution and ongoing communication from the project team are crucial for building trust and confidence in the crypto community.

Anywhere in the World

Anywhere in the World  (work in progress & patent pending)

(work in progress & patent pending)